Costs of land, machinery, labor, fuel, seed, fertilizer and livestock feed are expected to continue to increase sharply, greatly impacting American farmers’ bottom line over the coming months. However, as of today, farmers are in a strong position despite reduced government payments in 2021. Net farm income is estimated to have increased by 19.6% in 2020 and is forecasted to increase another 19.5% in 2021 to $113 billion. Net farm income is at its highest level since 2013 and is 20% above its 2000-2020 average. With still historically low debt-to-equity and debt-to-asset ratios, U.S. farms are in a good financial situation.

Farmers have been taking advantage of their good financial position to invest in new equipment. Both AEM’s Quarterly North American Industry Conditions survey, which is based on perception data, as well as the monthly Ag Tractor and Combine report, which focusses on actual retail sales are positive on the industry.

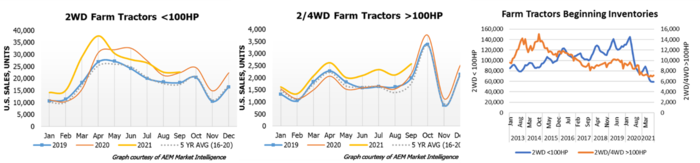

The most recent retail sales report shows the following that YTD, through September 2021, sales for 2WD Farm tractors <40HP, 40-100HP and 100+HP grew 10.5%, 12.9% and 26.2% respectively. These are great numbers as 2020 was already much higher than 2019 and the 5-year average. 4WD Farm Tractors clocked a fantastic 30% YTD growth and Self-Propelled combines came in around 11.3%. Compared to earlier in the year these last numbers have slowed down a bit. Inventories, however, are running very low. For <100HP the farm tractors are down to levels below 2011. We are down 39% YTD and down 58% of the all-time high in 2019.

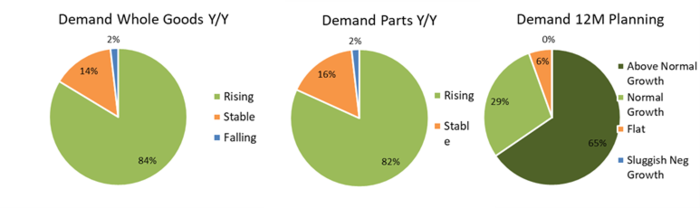

The Q3 2021, Quarterly North American Industry Condition Survey showed that 84% of AEM members say year-over-year wholegoods demand is rising, with another 14% saying demand is stable. The numbers are similar with respect to parts. Looking ahead to 12-month demand planning, 65% of AEM members anticipate above-normal growth, 29% expect normal growth, and 6% think demand will be flat. Nobody thinks demand will weaken.

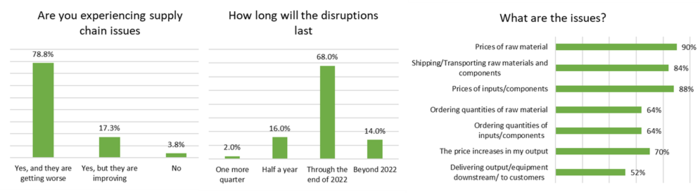

However, not everything is rosy in the Ag Equipment market. Like other industries, manufacturers are suffering from supply chain disruptions and inflationary pressures. More than 95% of AEM Ag members are experiencing supply chain disruptions both globally and domestically. Unfortunately, 79% think the disruptions are getting worse. While the bottlenecks are widespread, the biggest issues lie with the prices and shipping of raw material and components. Most AEM Ag members think supply chain issues will persist through 2022 (68% for Ag). Only a small percentage (14% Ag) think these issues will persist beyond next year. Some of these issues could very well last until 2023, such as semiconductors and variable frequency drives, which basically every factory uses.

High inflation levels are also compounding the supply chain disruptions. Inflation will remain high at >5% through 2021 into early 2022. In response to above-target inflation, but also the heating of the labor market, the Fed prepares to taper its programs and tighten monetary policy. Most key construction and agriculture equipment categories held fairly steady from August 2019 to August 2020. Over the past 12 months, however, it has been a much different story. The overall consumer price index climbed 5.25%.

This market update was provided by the Association of Equipment Manufacturers Business Intelligence Department. For more insights or questions, please email Director of Business Intelligence, Benjamin Duyck (bduyck@aem.org).

The Association of Equipment Manufacturers (AEM) is the North American-based international trade group representing off-road equipment manufacturers and suppliers, with more than 1,000 companies and more than 200 product lines in the agriculture and construction-related industry sectors worldwide. The equipment manufacturing industry supports 2.8 million jobs in the U.S. Equipment manufacturers also contribute $288 billion a year to the U.S. economy.