Net farm income, a broad measure of profits, is forecast to have increased by $23.9 billion (25.1 percent) in 2021 from 2020 and is forecast to decrease by $5.4 billion (4.5 percent) in 2022 relative to 2021. Forecast at $113.7 billion in 2022, net farm income would be 15.2 percent above its 2001–20 average of $98.7 billion when prior years are adjusted for inflation. Average net cash farm income for farm businesses is forecast to remain relatively unchanged from 2021 at $91,500 per farm in 2022. However, the regional average net cash farm income outlook is mixed.

While 2022 cash receipts overall are expected to increase, lower direct Government payments and higher production expenses are expected to counteract their net effects. Direct Government payments are forecast to fall by $15.5 billion (57 percent) from 2021 to $11.7 billion in 2022, due to lower supplemental and ad hoc disaster assistance related to COVID-19. Nearly all expense categories are forecast to rise during the year, with the most significant increases in for the following feed expenses and fertilizer.

American farmers remain in a strong position despite reduced government payments in 2022. Farmers had been taking advantage of their good financial position to invest in new equipment. Both AEM’s Quarterly North American Industry Conditions survey, which is based on perception data, as well as the monthly Ag Tractor and Combine report, which focuses on actual retail sales, are positive.

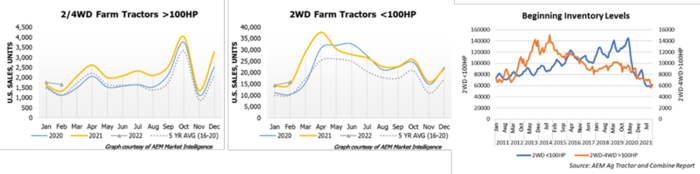

YTD, 2WD Farm tractor sales <40HP, 40-100HP and 100+HP grew 5.1%, 1.1% and 17.1% respectively; a bit above last year and 2021 was already much higher than 2020 and the 5-year average. 4WD Farm Tractors came in around 5.1%, so also a little slowdown and Self-Propelled combines came in around -25.6%, quite the drop from before. Compared to last year these numbers continue to slow down a bit, but mostly because the seasonality for combines is later in the year, for large tractors its around October and smaller tractors it’s in the end of the first quarter. Inventories, however, are running very low, below 2011 levels. This reflects the supply chain disruptions our industries continue to experience.

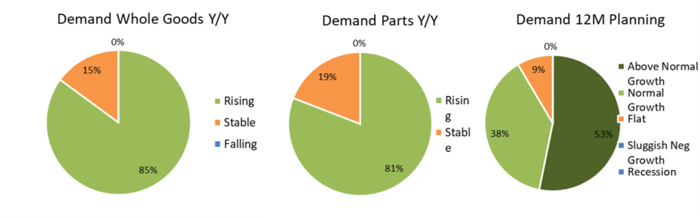

The Q4 2021, Quarterly North American Industry Condition Survey showed that 85% of AEM members say year-over-year wholegoods demand is rising, with another 15% saying demand is stable. The numbers are similar with respect to parts. Looking ahead to 12-month demand planning, 53% of AEM members anticipate above-normal growth, 38% expect normal growth, and 9% think demand will be flat. Nobody thinks demand will weaken. Some members have voiced concern about false demand due to excessive orders caused by the supply chain issues.

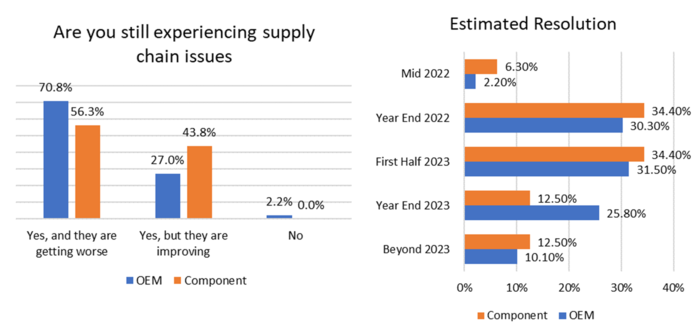

About 70% of the OEMs responding to our recent survey feel supply chain issues are getting worse. For about half of the component manufacturers they are improving, likely due to being up higher in the chain. When do our members feel the issues will alleviate? It seems the consensus lies around the end of 2022, beginning of 2023. However, this has proven to be a moving target (and also this was asked in February 2022, prior to the Russia-Ukrainian war).

This market update was provided by the Association of Equipment Manufacturers Business Intelligence Department. For more insights or questions, please email Director of Business Intelligence, Benjamin Duyck (bduyck@aem.org).