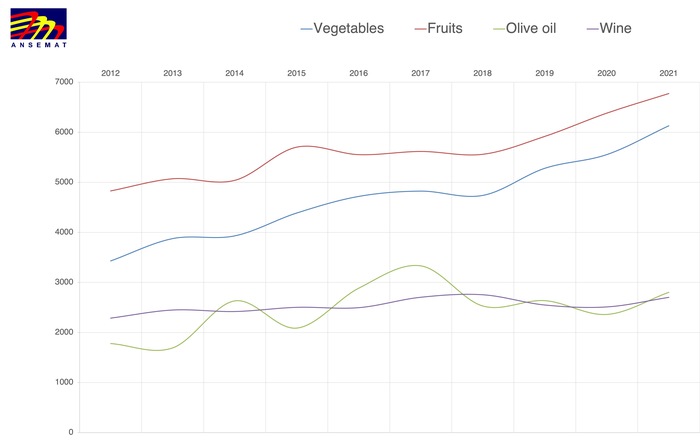

The agri-food sector in Spain has closed 2021 with a new increase in the balance of foreign trade, which has been close to 19 billion euros, doubling the figure reached a decade ago. High-value crops –fruits, vegetables, olive oil and wine– are four of the seven components of the sector that register positive differentials, and still have great growth potential in the coming years thanks to the growing demand in high income countries. The OECD-FAO report on agricultural prospects 2021-2030 concludes that during this decade, increases in production should be based on yields, and that trade flows will be limited to markets close to the producing countries. Faced with this expectation, a growing potential market for high-value crops is formed within the European Union, with south-north trade flows supported by the quality of Spanish products and the high income of recipient countries, whose citizens are already changing their diets towards these agricultural products.

The trade balance of high-value crops has exceeded 20 billion euros in 2021, which represents a growth of 42% compared to 2012, and the trend continues to rise thanks to the structural change that is taking place in the agricultural sector during these last years. If the areas dedicated to the different agricultural uses are compared in 2021 and 2004, important differences are observed by type of crop, which is the first step to explain the growth in exports of special crops. By area, they are olive groves and nuts –mainly almond and pistachio–, which have increased their cultivation area due to a change from other herbaceous crops; however, the price variable based on the quality and type of product has an even more important role in the evolution of these crops. In fact, between 2012 and 2021, vegetables have increased their exports by 39% in weight, but 69% in value, and fruit by 10% in weight, but 59% in value. For this reason, we refer to those crops as high-value crops.

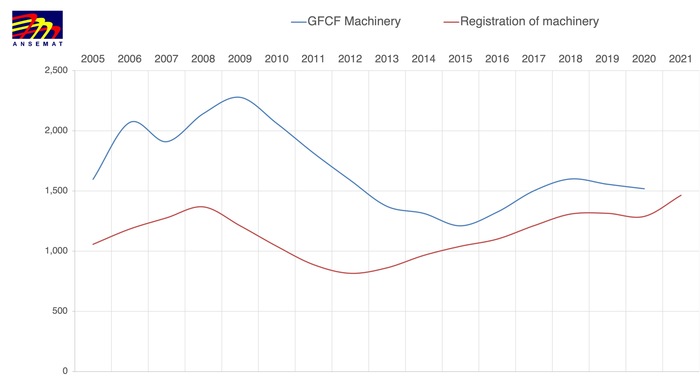

This change in agricultural production is now easy to observe and explain, but in the agricultural machinery sector it has been predicted in recent years by observing the drastic reduction that was taking place in investment in capital goods in Spanish agriculture. The change in agricultural production does not have short-term economic effects due to the time that must elapse before the plantations come into production, and agricultural income did not reflect the increase in the value of these crops in total production until 2019.

The consumption of fixed capital (to be distinguished from depreciation applied for tax or accounting purposes) should be estimated on the basis of the stock of fixed assets, the probable average economic life of the different categories of these assets, and their slow variation over time. This makes it possible to offer more favorable data on agricultural income –since the investment is subtracted from the gross value added– but hides the low level of annual investment that occurs in agricultural holdings. Normal wear and tear and foreseeable obsolescence of fixed assets during the accounting period constitute an expense, implicit as long as the asset is not replaced by a new acquisition. The consumption of fixed capital measures this wear and tear, but it does not show the annual investments by farmers.

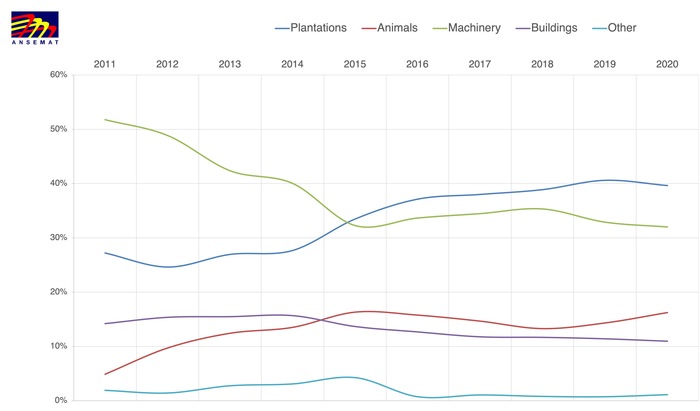

The Gross Fixed Capital Formation (GFCF) is the result of adding the investments made in new assets (both new and used imported) and used assets, and subtracting the sales of assets. As the purchase and sale price of a used asset is usually the same, what would be subtracted for the sales would be equal to what would be added for the purchases, therefore, the GFCF essentially represents the investments in assets that are incorporated by first time in economic activity. There are various types of assets, but the ones with the greatest share in the GFCF are machinery (portable equipment is excepted, since its value is usually amortized in less than a year, thus being considered as intermediate costs) and plantations (including, in the case of Spain, land acquisitions and improvements made to farms, such as irrigation systems).

In Spain there is a public register of agricultural machinery (ROMA), which offers precise data on units, types of machines and investment volumes, but which suffers from a problem: it does not include suspended machines. For this reason, the quantification of the total investment in agricultural machinery is not exact if only the ROMA is used; and as the Spanish Ministry of Agriculture (MAPA) does not publish the GFCF data on machinery, it is necessary to go to EUROSTAT to obtain said data and be able to evaluate the investment in capital goods.

What is interesting when comparing both databases is the reduction that is taking place in the investment of suspended equipment, since over the last decade both curves have shortened. High-value crops have been characterized by less mechanization and a greater role of human labor, mainly in harvesting tasks, so the reduction in GFCF is closely related to the reduction in investment in suspended equipment and the change towards investment in used equipment.

The stagnation of agricultural income after the decoupling of production aid has caused a disinvestment in arable crops, to which was added the stabilization of prices of staple crops after the food crises of 2008 and 2012. However, the pandemic that we continue to suffer along with the war in Ukraine, has brought speculation back to the markets that has raised the prices of cereals and that will increase the value of production in 2022 –although the increases in energy and fertilizers could leave farm income stagnated again.

Farms have reduced their investment in machinery but have allocated part of their income to investments in plantations, and according to the growth in exports described above, they are starting to show profitability. The latest data published in 2020 shows a volume of investment in plantations of 1,879 million euros, which represents a growth of 100% compared to 2011; while investment in machinery has plummeted 16% in the same period.

It is important to indicate that the GFCF of Spain in plantations accounted for 45.6% of the total in the EU in 2020, followed by France (16.9%) and Germany (12.3%). So the growth potential of high-value crops in Spain is high. An increase in investment in specific machinery for this type of crop can be expected in the medium term, for the farms that are commencing production, and in the long term, for new plantations where farmers are currently placing their investments.