Registrations of agricultural tractors up 17% from 2020 and at highest for at least a decade.

On 21st March 2022 CEMA released its annual tractor registrations press release, which is summarized here below.

When it comes to the beginning of 2022, CEMA bases its positions on the CEMA Barometer, and highlights the continuing supply bottlenecks and the impact due to the war in Ukraine. The newly-released April CEMA Barometer signals that the general business climate index for the agricultural machinery industry in Europe has continued to fall, with price increases and shortages on the supplier side continuing to challenge the industry heavily, and more than half of the companies planning a temporary production stop due to a shortage of certain parts in the coming months (read the April CEMA Barometer here).

Please see below the press release summary.

Brussels, 21st March 2022 – Nearly 230,000 “tractors” were registered across Europe in the full year 2021, according to numbers sourced from national authorities (figures cover most EU markets and some non-EU countries). Of these registrations, just under 30% were of vehicles of 37kW (50 hp) and under and the remainder were 38kW and above. CEMA considers that just under 180,000 of these vehicles are agricultural tractors. The rest are made up of a variety of vehicles which are sometimes classified as tractors, which includes quad bikes, side-by-sides, telehandlers or other equipment. An overview of the total tractor registrations can be found in the annex, including an indication of the proportion of registrations in each country which can be classified as agricultural tractors.

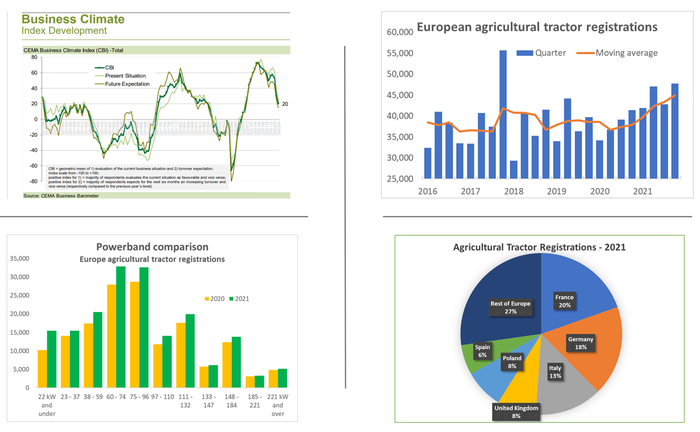

Agricultural tractor registrations for the full year 2021 increased by around 17% in comparison with 2020. Even allowing for the fact that the market in 2020 was disrupted due to the Covid-19 pandemic, particularly in the second quarter, this growth represents a significant improvement in market conditions. Indeed, the number of tractors registered was the highest recorded in comparable data which date back over a decade. These strong results were achieved despite widespread disruption to global manufacturing supply chains and staff shortages due to high Covid-19 infection rates.

Manufacturers warn of continuing production delays

Agricultural machinery manufacturers underline that disruptions to the smooth running of their production activities have multiplied over the last few months. Across the board, the situation has been worsening since the summer of 2021. Even before the crisis in Ukraine, in the February 2022 CEMA Barometer, 51% of the responding manufacturers said they expected some production stoppages due to supplier side shortages in the next four weeks. The issue is even more widespread among manufacturers of tractors and harvesting equipment, with respectively 64% and 71% of respondents reporting that they expected production stoppages. The war in Ukraine has triggered even more supply bottlenecks, as already apparent by early March in the CEMA Barometer.

These concerns add to other reported disruptions: transport and logistics, where the shortage of containers has caused a decided increase in costs and delays; manpower availability to run plants at full capacity due to the spread of the Covid-19 Omicron variant; rising commodity and energy costs.

As the disruptions further worsen and with the agricultural season of use upon us, manufacturers stress again their concerns regarding the possibility of fulfilling their orders in a timely manner despite all the efforts put in place across the value chain. The full impact of the war remains to be assessed.

Strong agricultural commodity prices support the market

While the tractor market was held back by the production delays, demand was consistently strong throughout 2021. A number of factors contributed to the level of demand but high and rising agricultural commodity prices were perhaps the most important. This is demonstrated by the global food price index published each month by the United Nations Food & Agriculture Organisation (UN FAO). This showed that food prices in 2021 averaged 28% higher than in 2020 and were at their highest level since 2011. Most farming sectors shared in the strong prices, with each of the component indices – covering meat, dairy, cereals, vegetable oils and sugar – at their highest for at least five years and the vegetable oils index at an all-time high. European prices for most commodities followed similar trends, although farm incomes were also affected by rapidly rising input costs, particularly for fuel and fertilisers.

Registrations grow across the whole tractor power range

All power categories recorded increased registrations in 2021 but growth was slower for the largest tractors. Among those machines classed as agricultural tractors, there was a 9% rise in the number of machines over 132kW, half the rate of increase which was recorded for machines with lower-powered engines. The strongest growth of all was for tractors of 22kW or below, registrations of which were up by more than half, compared with 2020.

Significant country differences for 2021

The two biggest agricultural tractor markets in Europe remain France and Germany, with those two countries accounting for almost four agricultural tractors out of every ten registered in Europe. Registrations in these two countries grew more slowly than across the rest of Europe in 2021, though, with rises of 10% and 9%, respectively. In contrast, growth in Italy and Poland, the third and fifth largest markets, was particularly strong, at 36% and 42%. Together with the United Kingdom and Spain, these countries account for a further 35% of European registrations. Only just over one in four new agricultural tractors registered in Europe is outside these six leading markets.

Further insights by economic experts from CEMA national associations are available in the full press release. The CEMA Barometer is available monthly here.