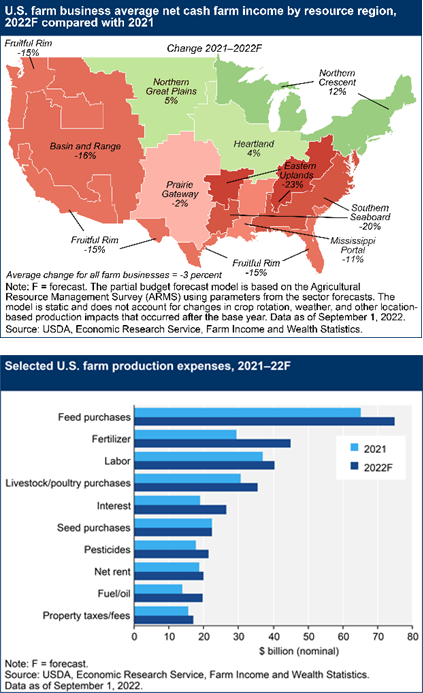

Net farm income, a broad measure of profits, is forecast at $147.7 billion in calendar year 2022, an increase of $7.3 billion (5.2%) from 2021. When adjusted for inflation, net farm income in 2021 was at its highest level since 2013 and 42.1% above its 20-year average (2002–21) of $104.0 billion in inflation-adjusted dollars. Total crop receipts are forecast to increase by $36.4 billion (15.3%) from 2021 levels to $274.2 billion. Total animal/animal product receipts are expected to increase by $55.3 billion (28.3%) to $251.1 billion, following increases in receipts for all commodity categories.

Direct government farm payments are forecast at $13.0 billion in 2022, at $12.8 billion (49.7%) decrease from 2021 levels. Much of this decline is because of lower supplemental and ad hoc disaster assistance to farmers and ranchers related to the coronavirus pandemic compared with 2021.

Total production expenses, including those associated with operator dwellings, are forecast to increase by $66.2 billion (17.8%) in 2022 to $437.3 billion. All categories of expenses are forecast to be higher in 2022 in nominal terms, with feed and fertilizer-lime-soil conditioner purchases expected to see the largest dollar increases.

American farmers remain in a strong position despite reduced government payments in 2022. Farmers had been taking advantage of their good financial position to invest in new equipment. Both AEM's Quarterly North American Industry Conditions survey, which is based on perception data, as well as the monthly Ag Tractor and Combine report, which focuses on retail sales, are positive on the industry.

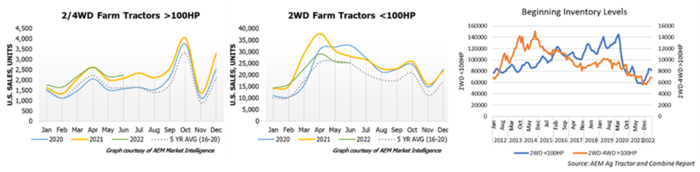

Retail sales for <40 Horsepower (HP) tractors Year-to-Date as of June were down 15.8% and 40-100HP were down 12.2%. 100+ HP tractor sales were up 10.3%, but for 4 Wheel Drive sales were down 13.4%. This indicates a reversal that took place earlier this year. The year over year numbers are slightly better, indicating that the biggest drops were earlier in the year. Self-propelled combine sales significantly increased year over year, but are still down YTD. >100HP tractor sales are still punching above the 5-year average and have shown improvements over the last few years, but <100HP sales have underperformed.

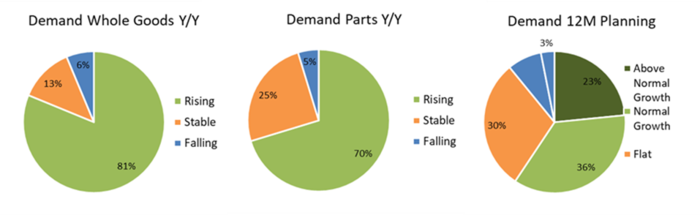

The Q2 2022, Quarterly North American Industry Condition Survey showed that perceptions of the agriculture equipment industry are more positive, but optimism is weighed down by several headwinds. An overwhelming percentage of AEM members feel the whole goods segment experienced growth over the last 12 months. For the next 12 months, more than half of members who responded indicated they expect normal or above-normal growth. Members continue to voice concern about false demand due to excessive orders caused by the supply chain issues and the impact of inflation

Inflation remains a concern as it makes equipment more expensive to produce and lowers income for agriculture equipment end users – the farmer. At the same time, anticipated higher interest rates (intended to combat inflation) will increase mortgage rates and loan rates. While some reports do show inflation slowing down over summer, it remains to be seen if this is just a blip or if the Federal Reserve's policies are working.

Supply chain issues, disruptive on their own, are also contributing to inflation. Almost every AEM manufacturer member continues to experience supply chain issues. Not that long ago, surveys indicated things were getting worse for about more than two-thirds of AEM members. Now, about half of association members reported seeing improvements.

When do our members feel the issues will alleviate? This has been a bit of a moving goalpost question. The shift is towards year-end 2023, but more manufacturers are indicating beyond 2023 than they were last quarter.

This market update was provided by the Association of Equipment Manufacturers Business Intelligence Department. For more insights or questions, please email Director of Business Intelligence, Benjamin Duyck (bduyck@aem.org).