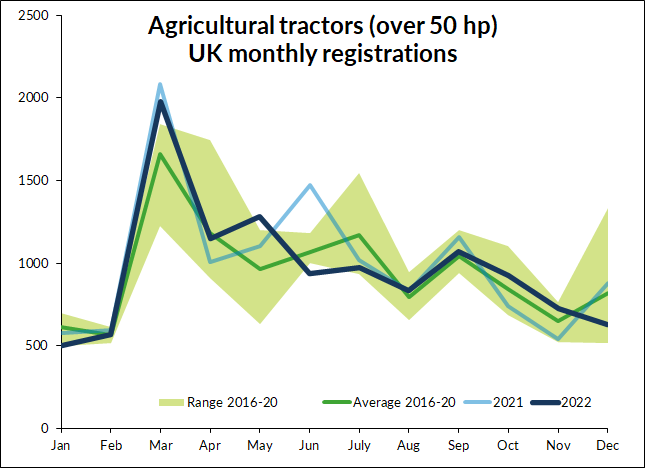

The number of agricultural tractors (over 50hp) registered in the UK in 2022 totalled 11,580 machines. That is 4% fewer than in 2021 but in line with the average for the previous five years. The total would no doubt have been higher but for the substantial disruption to global supply chains which meant companies were unable to keep up with demand from customers. Orders received were not as strong as in 2021 but were still above recent averages. Registrations did return to year-on-year growth in the final quarter of 2022, which may be an indication that extended lead times were starting to ease.

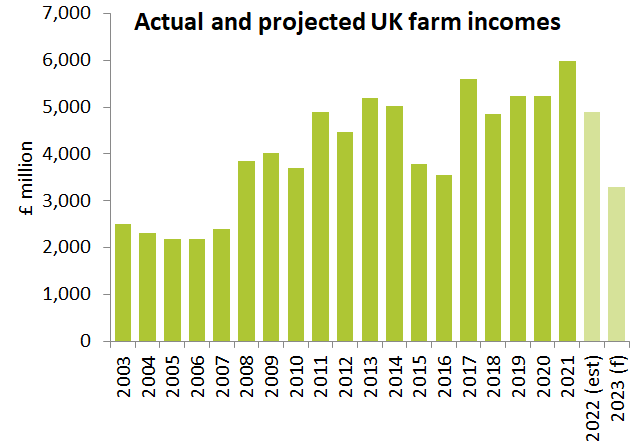

After a very strong year in 2021, farm incomes in the UK fell back in 2022 but were still around the average seen in recent years, as high prices for agricultural commodities outweighed rising input costs. Higher production costs may have more of an impact in 2023, meaning farm incomes are forecast to fall to their lowest level since about 2016, on the assumption that commodity prices will be lower than in 2022, although perhaps still higher than normal.

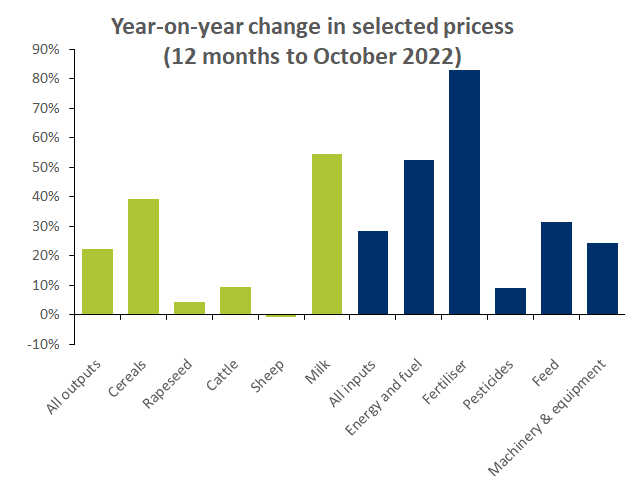

The impact of lower farm incomes on the machinery sector may be mitigated by high grain and milk prices, as these two sectors are the leading buyers of farm equipment. In the summer of 2022, UK prices for cereals, oilseeds and milk were all around 50% higher than a year before, although they have fallen a little since then. Input prices had increased by only about a third over the same period, though fertiliser and fuel were up by much more than that. However, other agricultural prices, such as those for livestock, fruit and vegetables, had gone up by less than inputs, even if livestock prices were also at record highs. It is these sectors which are expected to see the biggest impact of falling incomes in 2022 and 2023.

As well as high prices, which were driven by global markets, UK arable farmers benefitted from a good harvest in summer 2022, with yields and production above average. That was despite record high temperatures and drought conditions over the summer. That weather, combined with high feed prices, had a more negative impact on livestock sectors, with milk production lower than expected, providing a further boost to prices.

The pattern of solid demand outpacing manufacturers’ ability to supply customers, leading to extended lead times, wasn’t only apparent for tractors. Most other parts of the farm equipment sector saw deliveries to customers in 2022 which were slightly below those in 2021 but with a substantial backlog of orders remaining to be fulfilled. The value of orders outstanding at the end of August 2022 was four times as high as two years before and 60% up on a year ago. As a result, the mood in the industry remains positive, although perhaps not to quite the same extent as during 2021.

All this came despite wider UK economic conditions deteriorating. Some of this, such as rising inflation, high energy prices and slowing growth, were similar to what was being experienced elsewhere. However, volatility and uncertainty weren’t helped by the period of political turmoil in September and October, when there were two changes of Prime Minister in just a few weeks. Markets now seem to have stabilised but business confidence will take longer to return.