2022 TRACTOR AND COMBINE SALES

Combine harvester sales finished the year with healthy gains in unit sales while ag tractors finished the year below 2021 levels in both the U.S. and Canada.

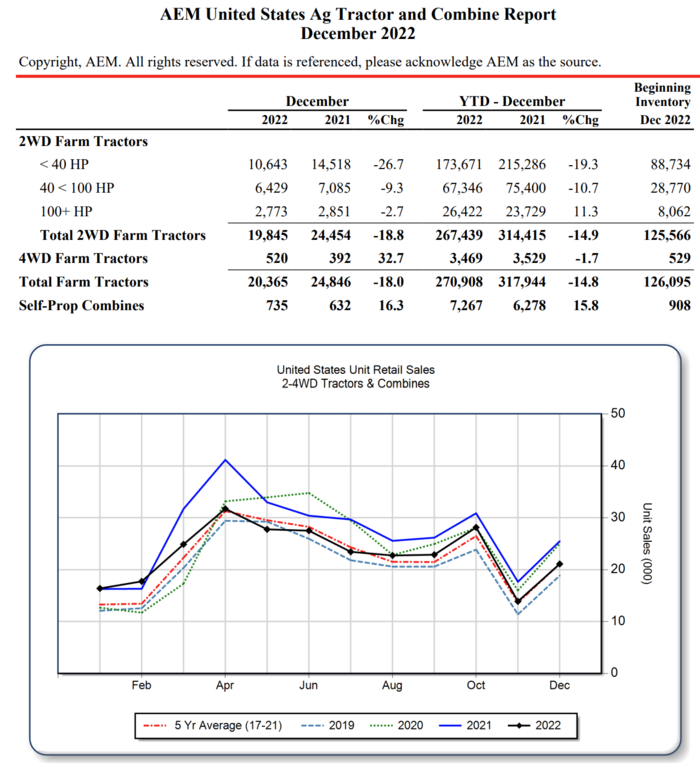

Total U.S. ag tractor unit sales fell for both the month of December as well as the year as a whole compared to 2021, with the sub-40hp segment leading losses in both timeframes, losing 26.7 percent for the month and 19.3 percent for calendar 2022. U.S. self-propelled combine sales, however, grew 16.3 percent on the month, finishing the year up 15.8 percent. Only one other segment grew for the year; 100+hp units finished the year up 11.3 percent despite losing 2.7 percent for the month of December. Total farm tractor sales in the U.S. for the year fell 14.8 percent versus 2021.

In Canada, combine harvesters led sales for the year again, up 10.7 percent, assisted by a 27.7 percent bump in December. Overall unit sales in tractors finished the year down 7.2 percent, with the sub-40hp segment leading losses north of the border as well, down 17 percent for December and 9.8 percent for the year. Conversely, 4WD units were the only tractor segment to finish the year positive, growing 6.3 percent for the year, helped by more than doubling sales in the month of December. Two-wheel-drive tractors above 100hp finished the year nearly flat, selling only 9 fewer units than the year before, putting that segment down 0.2 percent.

"The strength of combine harvester sales during this unusual time in ag markets is a testament to the advantages new technologies make in improving the quality and quantity of crops farmers can bring out of the field," said Curt Blades, senior vice president, industry sectors and product leadership at AEM. "And while other segments fell versus 2021, the previous two years saw the sales gains they did because of the pandemic, while this year was more a return to normal. That said, overall equipment sales finished near or above their 5-year average more often than not this year."

A LOOK AHEAD

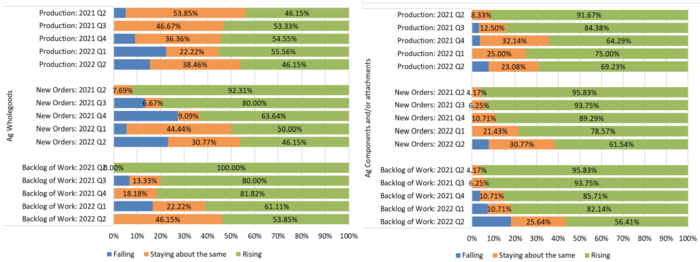

Per a survey conducted by AEM, agriculture equipment manufacturing executives anticipate slight and slow growth in upcoming months. Per the survey, key market Influencers include inflation, continued supply chain issues (which respondents feel are slowly improving and are expected to be mostly mitigated by Q1 2024), global trade relations tensions, federal assistance (continues to impact farm income), US elections (which bring much uncertainty to the market) and the continuing Russia-Ukraine conflict (bringing more uncertainty and price increases).