Agriculture Sector

In the second quarter of 2022, the value added of the agricultural sector recorded a slight decline on an annual basis (-0.7%), while the number of employees fell by almost 3% compared to one year ago, a decline linked above all to the decline in independents (-8%). In the second quarter of 2022, the expansionist trend in the prices of both national agricultural products (+ 24.9% on an annual basis) and current means of production (+ 24.5%) continued, in particular energy products (+ 81.5%), fertilizers (+ 46.2%), agricultural services such as third party jobs (+ 43.5%) and feed (+27.6). The general significant rise in prices supported the value of production but led to a worsening of the terms of trade which penalized farmers.

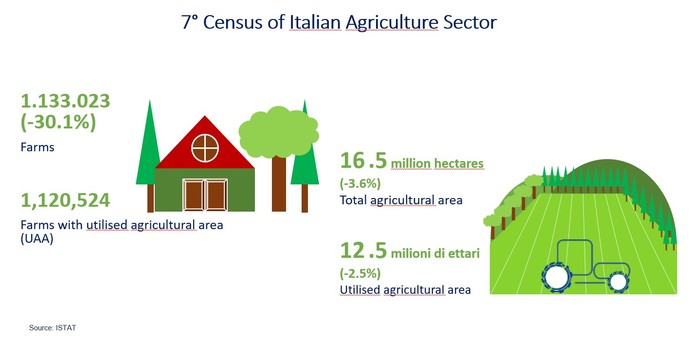

The new Census of Agriculture shows a picture with fewer but larger farms, UAA per farm in hectares was 8.0 in 2010 and now is 11.1.

Regarding cereals, the data recently released by Istat indicate a growth in area (+ 9.3%) and a decline in crops (-6.8% to 2.8 million / t). In general, the climatic trend was not very favourable to the crop, especially in the final stages of their growth. The protracted drought and the abnormal high temperatures in the ripening phase have led to a sharp decline in yields per hectare. Starting from June 2022, the wheat market shows signs of a fall in prices. In the coming months, durum wheat prices are expected to decline due to the strong recovery of harvests in Canada, while for common wheat the scenario is more complex and influenced by the events linked to the conflict between Russia and Ukraine.

Italian production of wine in 2022 was characterised by more quantity and better quality. Exports also did well in value, which in the first six months of 2022 was + 14% while in volume was stable. There are concerns for the slowdown in exports in the second quarter of the year. Retail wine sales prices in 2022 have fallen, but production costs are not expected to fall.

The trend in olive oil prices in Italy in the first nine months of 2022 recorded a slight decline for extra virgin olive oil. A 19% increase in the cost of technical production for olive oil has been recorded. Sellers feel that the increase in production costs cannot be transferred because consumers are already seeing loss of purchasing power.

Agricultural Machinery Production and Market

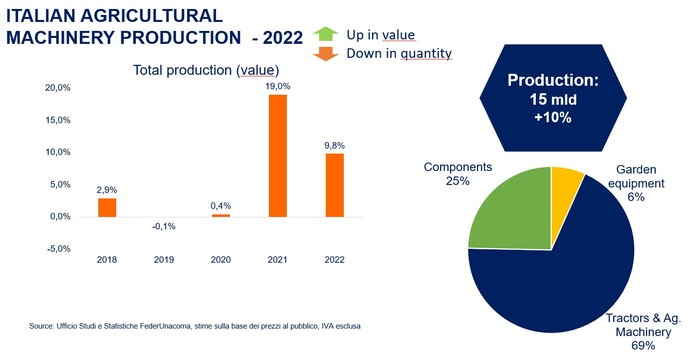

Production estimate is up in 2022 for the Italian agricultural machinery industry. Tractors will close the year with standstill in value (over 2 billion euro) and a drop of about 7/8% in quantity, while equipment and other types of agricultural machinery will rise by 12% to about 7 billion euros. The "tractor parts" also should show a substantial growth (+10%). If we add to these figures those relating to the components, which is estimated to have reached a value of almost 4 billion euros at the end of the year, and those relating to gardening machinery and equipment (980 million), the overall value of production in the Italian agro-mechanical sector in 2022 should reach 15 billion euros, for an increase of 10% over 2021.

In the first eight months of the year, the agricultural machinery market confirmed high sales volumes, albeit lower than the record levels reached in 2021. The registration figures indicate, in the period from January to August, a 13.8% decline for tractors, with 14,252 units registered, a number that remains above the average of the last four years. Registrations were also down, but still at high levels, for combine harvesters (-17.8% compared to 2021) with 267 units sold. A more consistent downturn characterises the performance of telescopic handlers (-27.3% to 760 units sold), the product type that had grown the most as of august 2021 (+87%). Trailers were also down, with 6,747 units registered, down 9.5% compared to the same period of 2021.

The market is still characterized by a good demand for agricultural machinery, however, the variables related to production costs have a strong impact.

Although agricultural commodity prices have risen in recent months, offsetting, to some extent, the rise in agricultural production costs, the rise in prices still hit the machinery market: throughout the year, farms have less and less profit margins to invest in the purchase of new machinery, and at the same time the industry is forced to adjust prices to try to absorb the substantial increases in production costs.