In hindsight, the strong potential of the regional markets and favorable rains throughout the country in the 2020 - 2021 season resulted in lucrative crop production, which led to high sales volumes for Turkish manufacturers. This helped the agricultural machinery industry recover from the detrimental effects of the COVID-19 pandemic. According to preliminary data, the farm machinery exports of manufacturing companies brought in about 1,6 billion dollars in 2022. Thus, Turkey’s agricultural machinery exports spiked to 14.3 percent last year.

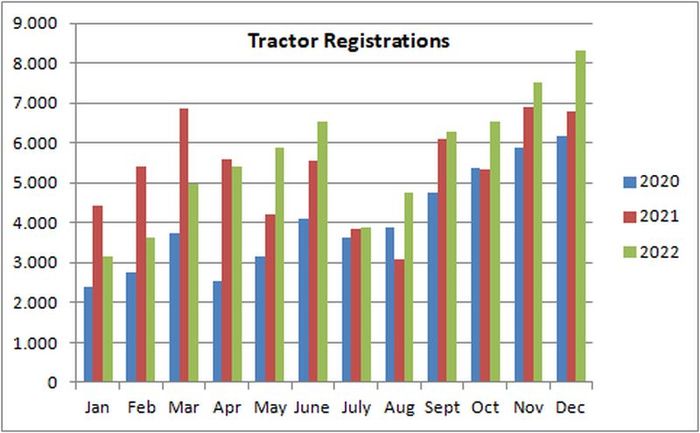

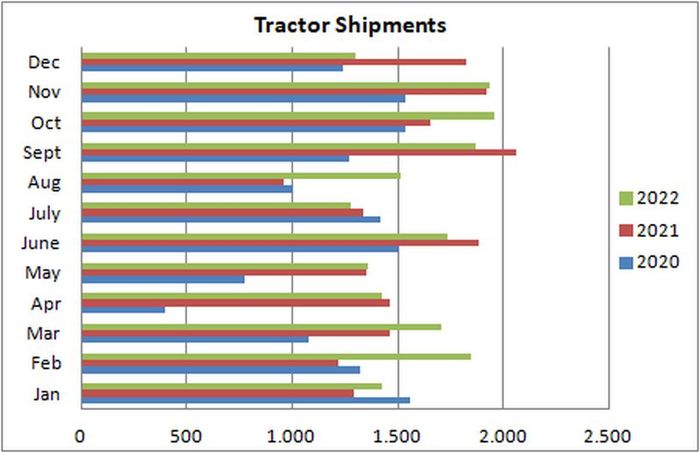

Deterioration in the supply chain still affects the tractor industry significantly. The 2022 fiscal year registrations indicate a 4,5% upward trend and 66,943 tractors were registered to the traffic after Turkey's agricultural tractors market grew by a massive 44.12% in 2021. Due to supply chain problems which caused long lead times, Turkish tractor makers did not satisfy the growing demand of farmers, and therefore the sales volumes were lower than expected in 2022.

While the subsidized agricultural loan interest rates, which are quite low compared to high inflation in Turkey, positively affected the demand for tractors in this period, the decrease in purchasing power due to high inflation / low income and the need for much higher working capital of farmers reflects negatively on the sale of other agricultural machinery. The high increase in raw material and energy prices is naturally reflected in the price tags. As of the end of 2022, the domestic producer price indices for agricultural machinery are in line with the general index. In December 2022, TUIK D-PPI increased by 97.7 percent annually, while agricultural machinery D-PPI reached 1,460.8 points, increasing at the level of 95.9 percent compared to the previous year.

Among Turkey’s power segments, in recent years 50-59HP range tractors accounted for the largest share due to their affordability, compact size and flexible operational capabilities. The primary factor for the steady growth of the medium-power range of tractors is that the tractor is used as an investment tool and a social rank among farmers. Although to a lesser extent, in an environment where high inflation continues, the concern that prices will increase even more also affects the purchasing decisions of buyers and brings it forward in terms of timing. The sales of Above 150 HP tractors in the country remained steady during this period as buyers' tendency was more likely to prefer lower power groups.

On the other side, TARMAKBIR recently issued a report highlighting the progress in global trade during fiscal 2022. The report outlined that Turkish tractor makers exported 19.346 units of tractors and total tractor exports increased by 5.5% compared to the same period of the previous year.

While this is the case for tractors, economic developments still adversely affect the domestic market for equipment. Since agricultural machinery other than tractors is not subject to registration, there is no baseline data. However, according to market observations, there is a decrease in quantity of 40 percent -- bearing in mind that 2021 was an extraordinary year in sales of agricultural machinery other than tractors.